Renters Insurance in and around Mendota Hts

Your renters insurance search is over, Mendota Hts

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- mendota heights.

- minnesota

- eagan

- saint paul

- west saint paul

- sunfish lake

- cottage grove

- inver grove heights

- woodbury

- washington county

- dakota county

- ramsey county

- bloomington

Home Is Where Your Heart Is

Your rented space is home. Since that is where you make memories and kick your feet up, it can be a wise idea to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your couch, tablet, table and chairs, etc., choosing the right coverage can help protect your belongings.

Your renters insurance search is over, Mendota Hts

Your belongings say p-lease and thank you to renters insurance

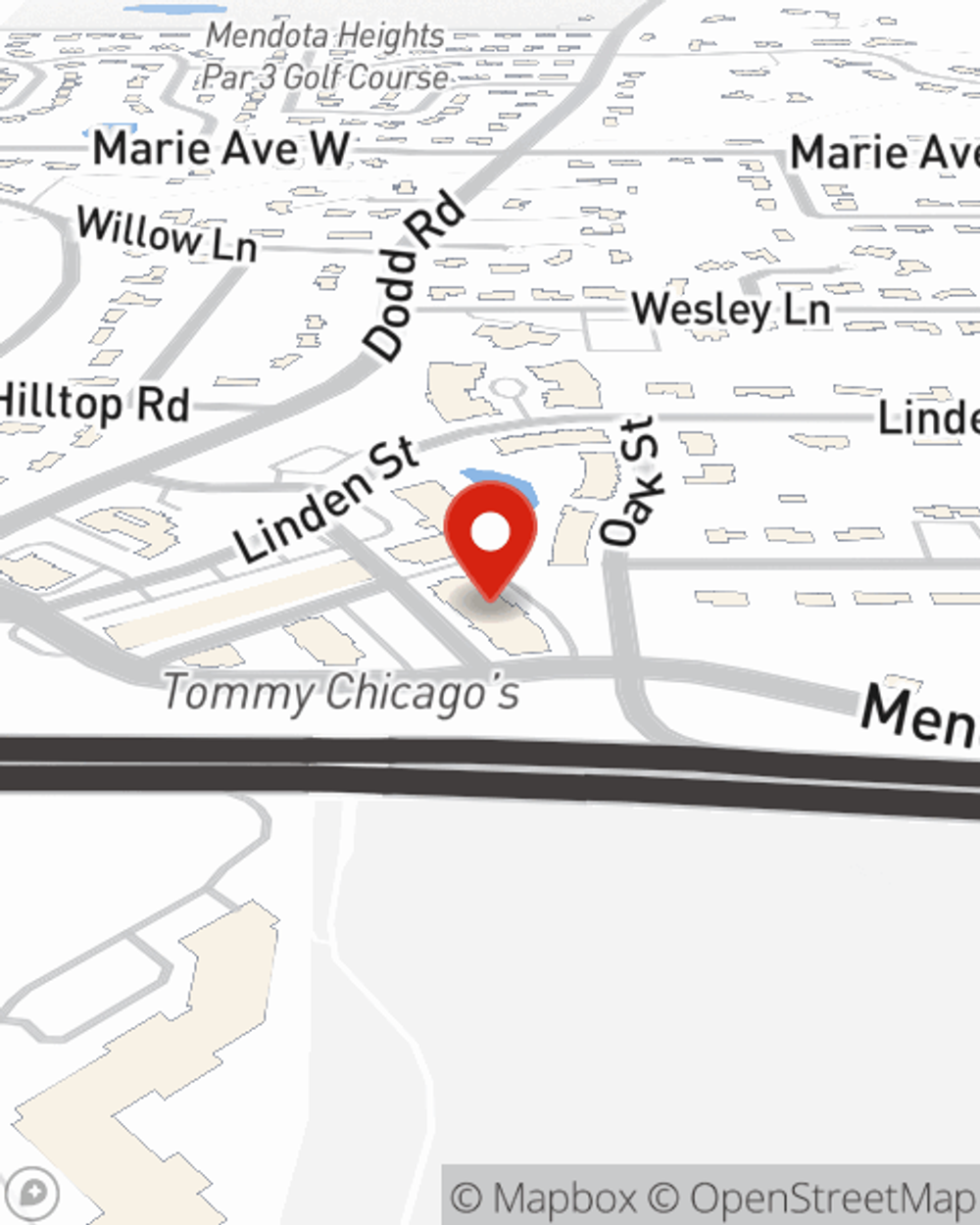

Agent Dustin Stifter, At Your Service

Renters frequently underestimate the cost of replacing their belongings. Just because you are renting a home or apartment, you still own plenty of property and personal items—such as a bicycle, set of favorite books, desk, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why get renters insurance from Dustin Stifter? You need an agent with a true desire to help you evaluate your risks and examine your needs. With competence and dedication, Dustin Stifter is waiting to help you insure your precious valuables.

Contact Dustin Stifter's office to explore how you can save with State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Dustin at (651) 348-2918 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Dustin Stifter

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.